16 August 2024

Money Issues: Getting Back on Track

Today's Financial Landscape

Although the latest ILCU report (1) shows a more positive financial outlook, many of us are understandably wary of being too optimistic about the state of the economy and the country’s finances.

The ILCU report, published on the 26th of July states that; “Consumer confidence hits 2 ½ year high on easing in cost-of-living concerns and continuing economic gains” but “July sentiment reading still below long-term average suggesting consumer gloom hasn’t been replaced by consumer boom.” It’s been a long few years, dealing with the pandemic, Brexit, the Ukraine war, rocketing energy prices and inflation, the war in Gaza, unprecedented immigration and the civil unrest that followed, not to mention ECB interest rate hikes and ongoing job losses in the tech sector. It would be hard to find a person living in Ireland today that hasn’t been financially impacted by at least one of these issues.

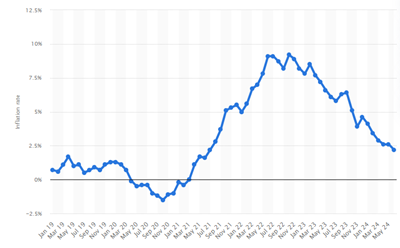

The substantial increases in inflation in Ireland between 2021 and 2022 resulted in consumer prices increasing rapidly. Although inflation has declined considerably this year, the previous high levels have already strained many households' budgets, creating ongoing financial stress for individuals and families.

Graphic Source: https://www.statista.com/statistics/1346108/ireland-inflation-rate/

Irish Inflation 2019 - 2024

Graphic Sourced From:

https://www.statista.com/statistics/1346108/ireland-inflation-rate/

High energy prices have also contributed to the cost-of-living crisis, affecting both personal finances and business operations. Despite some recent reductions in energy costs, the lingering effects of previous hikes continue to impact consumers.

Additionally, housing costs and availability remain a significant concern. Although housing completions are projected to increase, with overall Irish construction output projected to grow by 3.9% in 2024 and 5.7% in 2025, according to a recent report published by EY (2), the current supply still falls short of demand, leading to persistent housing price inflation.

This shortage exacerbates the financial pressure on those looking to buy or rent homes in Ireland. The CSO states (3) that, the national Residential Property Price Index (RPPI) increased by 5.4% in the 12 months to January 2024, with prices in Dublin rising by 4.5% and prices outside Dublin up by 6.1%.

Managing day-to-day expenses represents the number one financial concern for many people in Ireland today so here are some practical tips to help you manage day-to-day expenses in the face of these challenges.

Practical Tips to Boost Your Financial Game

1. Create a Detailed Budget

A comprehensive budget is the cornerstone of effective financial management. Start by tracking all income and expenses to understand where your money is being spent. Categorise expenses into essential (housing, utility bills, groceries) and non-essential (eating out, entertainment). Utilise budgeting apps or tools such as the one available from MABS(4) to monitor your spending. Sometimes just having a bit more visibility on how much is being spent in certain areas can be enough to nudge you into making a few changes or looking at alternative options.

2. Prioritise Savings

Establishing an emergency fund is crucial, especially during times of financial uncertainty. Having a bit of a safety net there for unexpected costs like broken appliances can really put your mind at ease. Aim to save three to six months’ worth of living expenses based on your current outgoings. Automate your savings by setting up a standing order from your main account into a savings account. If you can manage it, consider a separate long-term savings account for retirement or large future purchases. As a guide, the widely used 50-30-20 rule says that you should be spending 50% of your net income on your needs, 30% on your wants and 20% on your financial goals.

3. Reduce Utility and Energy Costs

Energy costs are a significant part of most household expenses. Simple changes like using energy-efficient appliances, insulating your home, and being mindful of electricity usage can lead to substantial savings. Compare energy providers to ensure you’re getting the best rates and consider switching if a more cost-effective option is available. Many financial providers, including Mountmellick Credit Union offer low interest rates on loans for energy upgrades to your home. Combined with SEAI grants (5) this can really have an impact on the final cost, so if you are considering energy upgrades, research all of your options.

4. Cut Non-Essential Spending

Set yourself a challenge to identify and reduce your discretionary spending. This could involve eating out a bit less or looking for better value options, cancelling unused subscriptions, and finding cheaper (or free) alternatives for entertainment. Small changes can add up over time, freeing up money for more important expenses.

5. Shop Smartly

When it comes to groceries and daily necessities, shop strategically. Look for discounts, use coupons, and buy in bulk for anything that won’t go off. Compare prices between different stores and online platforms to ensure you’re getting the best deals. Planning meals and creating shopping lists is brilliant for preventing impulse buying and reducing waste. Batch cooking allows you to have meals ready for those days you are short on time and energy which means you are less likely to buy expensive and low quality convenience food. It also reduces the amount of energy you use when cooking!

6. Manage Your Debt Wisely

High-interest debt can significantly strain finances. Focus on paying off high-interest debts first, such as credit card balances and short-term loans. Shop around for better rates on credit cards or better still cut up the cards! Consider consolidating debt to avail of lower interest rates and simplified payment schedules but remember that this may mean extending the term of your loan(s) so evaluate what works best for you.

Mountmellick Credit Union encourages you to make contact with us at the earliest possible opportunity to inform us of any changes in your circumstances or any temporary financial difficulty you may be experiencing.

Your Credit Union is ready to work with you to help you through any difficulty you are having in meeting your loan repayment. It’s very important to make contact with us at the earliest opportunity to discuss your options and to keep us informed.

If you are having difficulty in meeting your loan repayments, please contact us by phone on 057-862 4425 or by email at creditcontrol@mountmellickcu.com, you are welcome to call in to meet with an advisor, but we understand this is a difficult time and you may prefer the initial contact to be by phone or email.

If there has been a permanent change in circumstances / if your income has permanently reduced, then the Credit Union may assess the possibility of rescheduling the loan (reduce the repayment / extend the repayment term)

T&Cs apply along with maximum repayment terms as per the Credit Unions lending policy.

7. Utilise Public and Community Resources

Take advantage of public services and community resources designed to help manage costs. This includes accessing public libraries for free books and media, participating in community events, and utilising public transportation.

8. Optimise Housing Costs

Given the high cost of housing, exploring ways to reduce this expense is something you could consider. Downsizing, finding a roommate, or negotiating rent reductions are all ways you may be able to reduce your outgoings. For homeowners, refinancing a mortgage to take advantage of lower interest rates could result in significant savings.

9. Plan for the Future

Investing in education and skills development can improve job prospects and earning potential. This might involve taking courses, attending workshops, or obtaining certifications. A higher income can provide more financial stability and the ability to handle rising living costs more effectively.

10. Stay Informed and Seek Advice

Keeping yourself informed about financial trends and opportunities can help in making better decisions. Follow financial news and consult with financial advisors when needed. Professional advice will give you personalised strategies tailored to your individual circumstances.

The key lies in being proactive, making informed decisions, and being willing to adapt to changing economic conditions. With a few small adjustments, it is possible to achieve greater financial stability and peace of mind.

References:(1) https://www.creditunion.ie/news/latest-news/irish-consumer-sentiment-notably-hotter-in-july/